Did You Know That | week 18/2024

Did You Know That | week 18/2024

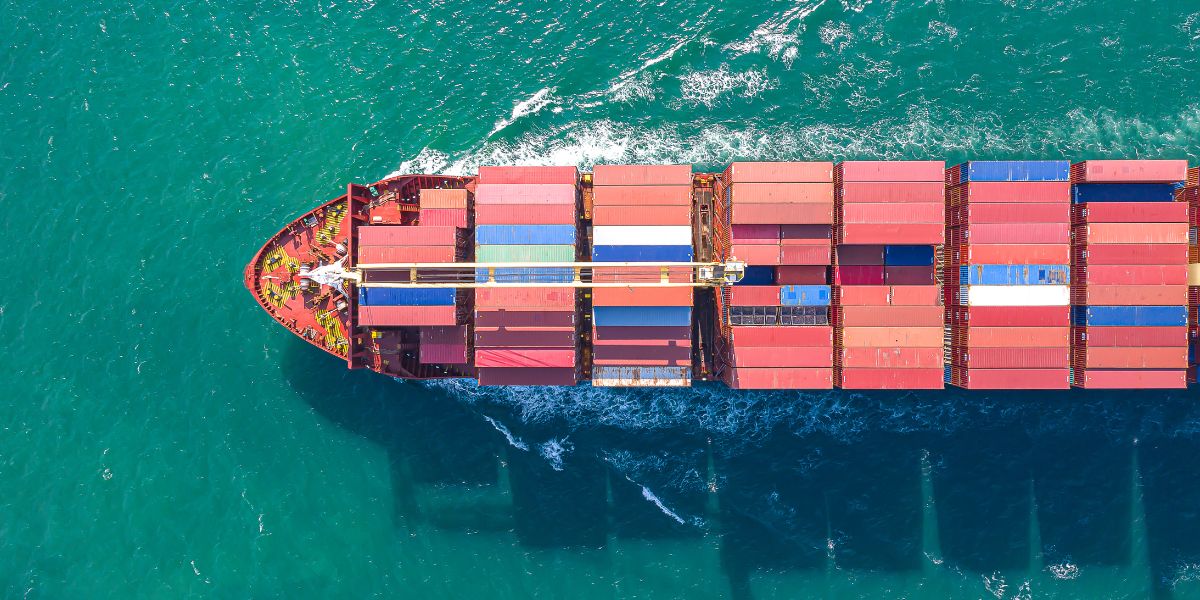

Maersk remains cautious on capacity outlook. Market fundamentals are being delayed, but carriers cannot defy gravity in the long run.

Maersk remains cautious on capacity outlook. Market fundamentals are being delayed, but carriers cannot defy gravity in the long run. Capacity shortages and strong demand have propped up freight rates and will do so for another quarter. But beyond that, the looming threat of overcapacity remains, even if the Red Sea crisis continues.

According to a Maersk press release, The knock-on effects of the situation in the Red Sea have included bottlenecks and vessel bunching, as well as delays and equipment and capacity shortages. We estimate an industry-wide capacity loss of 15-20% on the Far-East to North Europe and Mediterranean market during Q2.

Reported by Steven Yuan from FS China, shipping lines are looking for a hike in Asia-Europe spot freight rates, announcing a series of new prices from 1 May to ports in North Europe and west and east Mediterranean.

Currently, there hasn’t been a significant decrease in space supply on the market. The factors driving this recent increase are largely related to the rise in cargo volume. Some shipping companies have reported a noticeable increase in the volume of solar panel products recently, possibly due to the tightening policies by the European Union on Chinese solar energy products.FAK prices range from USD3650 to 4100 per 40HQ (report date is 26 April).

Colombo cashes in on Red Sea rerouting at expense of Saudi majors. Jeddah and King Abdullah continue to bear the brunt of container shipping’s Red Sea. Transhipment traffic may have ground to a halt in the Red Sea, but Sri Lanka’s hub-and-spoke specialist has reaped the rewards of the trunk liner trades’ southern migration. For ships rerouting around the Cape of Good Hope, Colombo is positioned as an unrivalled wayport option for Middle East and Indian subcontinent cargoes.

Container demand uptick may be temporary. Shippers are building up inventory that is not related to extra sales. Carriers are reporting strong demand and high load factors. But Red Sea delays have prompted cargo owners to bring forward orders that may turn into excess inventory.

Unifeeder expands into Latin America. Unifeeder Group, part of DP World, has opened an office in Panama City and launched additional feeder routes.

Faster sailings from Asia to Mexico. OOCL has introduced the Transpacific Latin Pacific 5 (TLP5) service to enhance its Asia-Latin America network. The new route offers direct connections between China, Korea, and Mexico, with fast transit times of 15 days from Qingdao to Ensenada and 20 days to Manzanillo.

A third air cargo centre at Liège airport. Swissport International continues to grow at Liège airport, Belgium, one of Europe’s major gateways for international air cargo. The company’s third cargo centre, a custom bonded warehouse, was built in response to an increased demand for e-commerce and forwarder handling.

Jilin: improved intermodal access. The two transport companies Fesco (Russia) and Geo Tour Logistics (China) want to jointly develop land-based transport services for containers between the city of Hunchun (Jilin Province, China) on the Russian/North Korean border and the Russian and Chinese ports.

Temporary Baltimore channel closes as focus turns to Dali removal. Permanent channel on track to reopen by end of May. Authorities closed the temporary Fort McHenry channel that opened on Thursday as efforts shift to remove the Dali. The channel’s opening allowed for most vessels that were stranded at the port since March 26 to depart.

As reported by our friend Mariam Kassir (without being biased) from Transolve in Australia (headoffice in Sydney), Sydney has been dubbed the most relaxed city in the world. A new study has revealed the most laid-back locations across the globe, and Sydney has topped the list. Read the complete article on: https://www.timeout.com/sydney/news/sydney-has-been-dubbed-the-most-relaxed-city-in-the-world-042624.

Puzzled by Aponte’s Gram Car Carriers deal? Don’t be. Buying a vehicle carrier tonnage provider isn’t an obvious move for the shipowners’ shipowner. But look a little closer and it all makes sense. After putting together the world’s biggest shipping empire in little over five decades, it’s safe to say this guy knows what he’s doing.

Global maritime city rankings in 2024. The 2024 “Leading Maritime Cities of the World” report, rigorously evaluates global maritime hubs. Singapore claims the top spot this year, excelling in digital transformation and green technology. Europe also features prominently, with Rotterdam, London and Oslo making the top five. Shanghai ranks fourth, Germany’s Hamburg is in eight place.

China and Serbia strengthen trade ties. The state-owned company Zhengzhou International Hub (ZIH) has launched a railfreight service to Serbia.

Maersk’s reported $600m investment in Nigeria is news to Maersk. Chairman Robert Maersk Uggla met Nigerian president Bola Tinubu over the weekend, but no new investment deal was signed. Nigerian president Bola Tinubu claims to have secured an investment of $600m from Danish shipping and logistics giant Maersk, but that appears to be news to Maersk.

Hong Kong International Airport (HKIA) registered a year-on-year increase in its monthly cargo throughput for the third month in a row, with a 15.1% rise to 428,000 t in March. This uptick comes on the back of another successful year in 2023, with the airport once again named the “busiest cargo airport in the world” by Airports Council International.

Escalating protests expose three fault lines on American elite campuses, including Columbia and Yale. Universities struggle with how to regulate free speech and other rules. Pro-palestinian protests and police crackdowns are escalating at American universities. A phalanx of New York police with battering-rams entered Columbia University on the night of April 30th, joined by an armoured vehicle with an elevated ramp known as a BearCat, a cross between a tank and a fire engine.

University protests about Gaza spread to the Middle East. But Arab students are looking to America for inspiration. “We see our comrades from Columbia to Chicago”, says Tom, a Lebanese student at the American University of Beirut (aub), who did not want to give his full name. He was one of over 100 students at a demonstration on the aub campus on April 30th “inspired”, he says, by their American counterparts. Students in Egypt, Jordan, Kuwait and Tunisia are also raising their voices.

Chinese EV-makers are leaving Western rivals in the dust. They have shone at Beijing’s car jamboree. Both on Beijing streets and at exhibition booths, most of the vehicles are electric. And Chinese marques, some more familiar to overseas visitors than others, and local technology champions such as Huawei and Xiaomi, better known for gizmos you carry than those that carry you, are edging out the foreign manufacturers that once dominated the domestic market. China’s carmakers are launching new models more quickly, and much more cheaply, than rivals abroad. Bernstein, a broker, reckons Chinese evs can cost half as much to buy as European ones, while boasting better tech.

Red Sea closure a mixed bag for Africa. Despite increased services around Africa, only a small number ships are making calls. Higher costs and closed trade lanes are hitting African countries hard. But there are opportunities for the continent to benefit in the longer term.

Voting in the world’s largest election started in India.

Riyadh Dry Port welcomes first Jubail train . Original: To enhance the connectivity between maritime and rail transport modes and improve the efficiency of logistics operations within the transportation and logistics system, the first container shipment was transported from Jubail Commercial Port to Riyadh Dry Port.

Why do the Japanese love CDs?. They have not taken to streaming as keenly as the rest of the world. In Japan it seems time has stood still. In 2023, 39% of recorded revenues came from cds there, making Japan the second-biggest music market globally.

The average employee spends four hours a week complaining about his or her superiors..

Wishing you all a great rest of the week ahead!