Did You Know That | Week 04 – 2024

Did You Know That | Week 04 – 2024

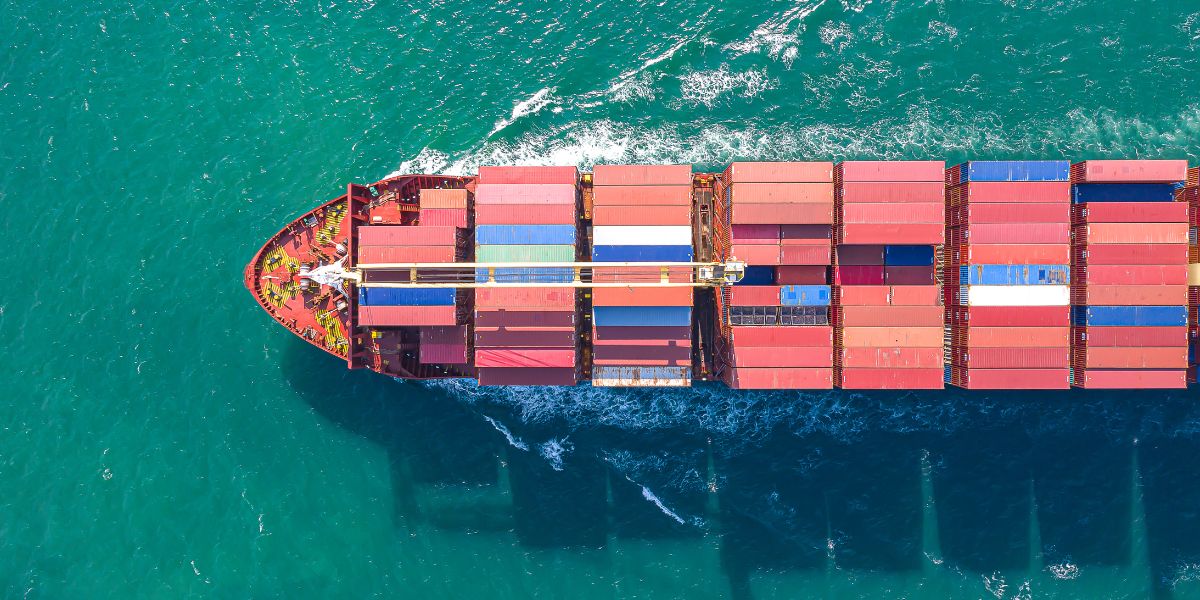

Gemini Cooperation in ‘strong position’ to compete on deepsea capacity. New liner consortia will operate nearly 300 ships under its new network with a combined capacity of around 3.4m teu.

Gemini Cooperation in ‘strong position’ to compete on deepsea capacity. New liner consortia will operate nearly 300 ships under its new network with a combined capacity of around 3.4m teu. The tie-up between European container line heavyweights Maersk and Hapag-Lloyd could see the pairing become the dominant force on key trade routes. However, the Ocean Alliance will far outweigh other joint enterprise rivals and independent operator MSC owing to its overall capacity offering, according to analyst forecasts.

Second-largest drop in trade capacity. The now month-long Red Sea crisis has caused the second-largest drop in trade capacity in recent times and destabilised service networks, particularly affecting Asia-Europe routes.

CMA CGM continues to run Red Sea gauntlet. French carrier is still utilising the Bab el Mandeb with military support as major carriers pull back further.Containerships in the Red Sea are becoming increasingly rare. Maersk is now also avoiding the Gulf of Aden, while Hapag-Lloyd is looking to use a land bridge for Red Sea cargoes.

About such a land bridge, as shippers and forwarders consider a switch to sea-air and airfreight solutions in response to the Cape detours resulting from the Red Sea crisis, another alternative has emerged – a land bridge across the Middle East. Israeli digital freight marketplace Trucknet Enterprise has teamed up with UAE-based PureTrans, which operates a landline transit network, its partner, DP World, Cox Logistics (Bahrain) and Egypt-based logistics firm WWCS to provide trucking services connecting the Dubai port of Jebel Ali and the port of Mina Salman, in Bahrain. It goes via Saudi Arabia and Jordan to Haifa in Israel and Port Said in Egypt, from where cargo can continue to Europe and beyond.

Pace of container freight rate increases slows. Indices are still heading up but pace of rate rises is easing. Rates of Asia-Europe cargoes fell back this week, according to the Shanghai Shipping Exchange. But transpacific and backhaul trades have continued to rise.

Speed up or add ships? Carriers mull Asia-N Europe makeover options. As long as they are able to obtain premium rates, ocean carriers could decide to increase the service speed of their ships on the Asia-North Europe tradelane to mitigate the impact of Suez Canal diversions.With the Red Sea crisis unlikely to be resolved any time soon, shipping alliance members are busy recalibrating their networks to factor-in the longer transit times of rerouting loop vessels around the Cape of Good Hope.Moreover, in the process, the lines are consulting with their key accounts to determine the impact of the supply chain extensions.

INDIA, A Global Rising Power. India is considered one of the most promising developing nations in the current global order. India’s performance in several aspects of its international insertion, especially considering its economy, allowed its characterization as an emerging power in the current global order. In this sense, India can be described as a “rising power”, implicating transformations with the aim of reaching greater presence in the dynamics of the international system.

Find the attached document that was shared by our board member Globus Logisys in India, which will give you some information concerning India business in worldwide stage development.

The latest report by good old Steven Yuan of FS International China: Due to the upcoming Chinese New Year, shipping companies are stockpiling goods to establish a rolling pool. The market prices have experienced a slight decrease in February, with current prices ranging from USD4600 to USD4800 per 40HQ container at the beginning of February. It is anticipated that prices will further decline from Chinese New Year until mid-March.

Japan’s SLIM spacecraft lands on the Moon. This makes Japan the fifth country to achieve the feat.

Mysterious new Chinese carrier emerges to capitalise on risky Red Sea trades.Singapore-incorporated, China-controlled Sea Legend Shipping has swooped in to grab a slice of the high-risk, high-reward routes by snapping up secondhand tonnage. Emerging carrier claims to offer ‘ultimate care for crew, cargo and vessel with high-security level’ for its Red Sea transits. This includes escorts by the Chinese navy and private armed guards on board.

Singapore-incorporated start-up is taking advantage of the Red Sea crisis to launch a container shipping service to the high-risk area. Sea Legend Shipping was incorporated in February 2023 and is held by the British Virgin Islands (BVI)-registered Sea World Legend Holdings. A Singaporean, Deng Ping, is its director.Its website says Sea Legend owns 10 containerships, ranging from 1,800 to 4,900 teu claims that the Chinese navy is escorting its vessels through the Red Sea.Opportunistic operators have been capitalising on the lack of tonnage to start Red Sea services, as 90% of ships that used to transit the Red Sea are diverting round the Cape of Good Hope to avoid Houthi attacks.

Could Los Angeles be the new sea-air hub for Asia-Europe shippers? Shippers and their forwarders are getting more creative with new sea-air and road-air routes from Asia to Europe, amid Red Sea-associated shipping delays and a subsequent spike in sea freight rates, raising the fascinating prospect of California becoming a key node in Asia-Europe trades.

As reported by our est. member Transolve in Australia, the latest round of negotiations between DP World and the Maritime Union of Australia (MUA) failed to achieve any meaningful outcomes, further industrial action is set to continue across major Australian ports. With approximately 40% of Australia’s container freight managed by DP World, the ongoing industrial action which to date has included work stoppages, ceasing of receiver and delivery operations, bans on overtime and more, will further exacerbate delays.

China has lifted suspensions on three Australian meat export establishments with eight yet to be lifted. The conclusion of these initial suspensions is another positive step towards the stabilisation of the trade relationship between China and Australia. With renewed optimism regarding the removal of all the suspensions across Australian abattoirs, the Australian government is hopeful for trade restriction removals as well as the creation of new opportunities to export Australia’s agricultural products to the Chinese market.

The Australian Government will undertake trade agreement negotiations with the United Arab Emirates (UAE) in order to achieve a Comprehensive Economic Partnership Agreement that will drive imports, support economic growth and increase jobs stimulus across the country. As Australia’s largest trade and investment partner in the Middle East, with a trade value of $9.26 billion as at 2022, the UAE is already a key market for Australian goods and services exports including alumina, building, construction, meat, oil seeds, education and more.

Shark fins hiding among dry fish. One week ago, on 15 January 2024, Hong Kong Customs seized about 800 kg of suspected scheduled shark fins, with an estimated market value of about HKD 4 million (USD 500,000), at Hong Kong airport.

Wincanton sold for GBP 566.9 million. Ceva, a subsidiary of the French shipping company CMA CGM, is buying the British logistics provider Wincanton for the price of GBP 566.9 million.

Xi’an’s latest train en route to Poti . China has launched a new international freight service. Connecting Xi’an in northwest China’s Shaanxi Province, and Poti, a port city in Georgia. Shippers are currently opting for US West Coast terminals to avoid trade union action and disruptions on both the Panama and Suez Canals.

Tension increased between Iran and Pakistan after Iran launched a missile attack in western Pakistan.

Some additional remarks received from mr. Thomas Dubosc from Sealogis FF France on the item in last week’s dykt about CMA-CGM air.

- CMA remains share holder of AIR France/KLM and intend to stay that way

- What was declined is to operate as a common fleet but the two players will keep on operating their fleet independantly – that does not bring CMA out of the airfreight game

- The strong intention remains to get to an agreement and reach common fleet operating target.

Donald Trump is winning. Business, beware. What a second term would mean for American business and the economy. Some titan-American companies are deeply alarmed by the prospect of Trump 2. But others quietly welcome the chaos trade.People who run large organisations have to be optimistic. They must find opportunities when others are panicking. ceos had an uneasy relationship with President Trump, many distancing themselves from his most outrageous pronouncements and tut-tutting about protectionism, even as they enjoyed his more conventional policies.

How viable is Arctic shipping? Russia is investing in the region. There is a tantalising alternative for long-distance sea trade: a series of routes that could cut up to 40% off the length of journeys made via the Suez Canal. But there is a catch: the Northern Sea Route (nsr), North-West Passage (nwp) and Transpolar Sea Route (tsr) cross an ocean covered in ice. Could the Arctic be a viable option for commercial shipping? Increasingly, yes—and for a worrying reason. The Arctic is warming four times faster than the global average. Since 1978 ice cover has shrunk by roughly 78,000 square kilometres per year.

China’s economy grew by 5.2% last year, just above the government’s target of 5%.

Apple passed Samsung last year to become the world’s biggest seller of smartphones by volume.

According to accident statistics, the safest place in the car is in the centre of the back seat.